Why Now Is the Best Time to Invest in AI-Driven Renewable Energy Startups

Introduction

Imagine a world where your home knows when to switch to solar power, how to optimize your heating and cooling systems, and precisely when to store or sell excess energy back to the grid—all without you lifting a finger. Such scenarios aren’t merely futuristic fantasies; they’re unfolding in real time, thanks to AI-driven renewable energy solutions. And there’s never been a more opportune moment to jump in and invest in this sector.

Why now? Because clean power and artificial intelligence are converging to solve some of the biggest energy and climate challenges we face today. Rapid declines in the cost of solar panels, wind turbines, and battery storage have made renewables increasingly competitive. Simultaneously, the AI revolution has propelled software capabilities to new heights, empowering startups to innovate at lightning speed. When these forces meet, they create startups ripe for high returns on investment, robust growth, and a meaningful social impact that resonates with today’s eco-conscious consumers and governments.

In this article, you’ll learn:

- The core reasons why investment in AI-driven renewable energy startups is taking off.

- Concrete data and real-world examples that validate the sector’s potential.

- Step-by-step guides for identifying promising startups and structuring your investments.

- Case studies demonstrating how and where these breakthroughs are already happening.

- Common pitfalls that can hinder success, plus how to avoid them.

- Future trends shaping the direction of AI-powered green energy solutions in the years ahead.

- A motivating call-to-action to help you move forward with confidence.

Whether you’re a seasoned venture capitalist, an angel investor looking to make a difference, or simply curious about the future of sustainable energy, this post will arm you with the insights, tools, and strategies you need. The value you’ll receive? A deeper understanding of why now is the prime time to invest, what specific opportunities exist, and how to make the most of them.

Table of Contents

- Understanding the Rise of AI-Driven Renewable Energy

- Market Forces Fueling AI-Driven Renewable Energy Investment

- Core Benefits of Merging AI and Clean Power

- Step-by-Step Guide: How to Evaluate AI-Driven Renewable Energy Startups

- 4.1 Identify the Niche

- 4.2 Assess the Team

- 4.3 Examine the Technology

- 4.4 Check the Market Fit and Scalability

- 4.5 Review Financials and ROI Potential

- Case Studies and Real-Life Examples

- Common Pitfalls and How to Avoid Them

- Future Insights and Trends

- Conclusion

- FAQs

1. Understanding the Rise of AI-Driven Renewable Energy

1.1 The Tipping Point for Clean Power

For decades, renewable energy options like solar and wind were seen as aspirational but too costly and inefficient to replace fossil fuels entirely. In recent years, however, the cost of solar panels and wind turbines has plunged, making them highly competitive with coal and natural gas. According to the International Renewable Energy Agency (IRENA), solar PV costs have dropped by over 80% since 2010, while wind energy costs have fallen by nearly 40% during the same period.

In parallel, consumer demand for green solutions has soared, driven by mounting environmental concerns and supportive government policies. Nations around the globe are setting ambitious net-zero targets and offering tax incentives and grants to accelerate the clean power transition. Consequently, the renewable energy sector has grown from a niche segment into a trillion-dollar industry ripe with opportunities for innovation.

1.2 The Emergence of AI Across Industries

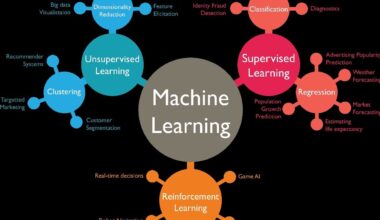

Artificial intelligence was once exclusive to tech giants and academic labs, but its infiltration into everyday business operations has been swift and sweeping. From machine learning algorithms that drive your Netflix recommendations to natural language processing powering your voice-activated assistant, AI is practically ubiquitous. The technology’s ability to analyze massive data sets, identify patterns, and automate tasks places it at the forefront of digital transformation.

In the energy domain, AI’s capabilities shine through in predictive maintenance, grid optimization, demand forecasting, and autonomous energy trading. These high-value applications make it a game-changer. AI startups are tackling fundamental challenges—like the intermittency of solar and wind—by using predictive analytics to enhance stability and predict energy output. This approach lowers costs, increases efficiency, and reduces carbon footprints, presenting a win-win scenario for both investors and the planet.

1.3 Convergence: AI + Renewable Energy

The perfect storm of falling renewable energy costs and expanding AI capabilities has created a fertile breeding ground for cutting-edge startups. The synergy is so strong because each technology addresses the core weaknesses of the other:

- Renewable Energy Gains: AI can refine energy forecasting, optimize storage solutions, and automate grid management, solving the issue of unpredictable supply inherent in renewables.

- AI Benefits: The massive data sets produced by solar panels, wind turbines, and smart meters feed machine learning algorithms the lifeblood they need—data.

As a result, AI-driven renewable energy startups are attracting significant capital, often growing at rates outpacing conventional energy ventures. Savvy investors realize they aren’t just buying into a single technology; they’re betting on a transformative trend that’s redefining the entire energy market.

2. Market Forces Fueling AI-Driven Renewable Energy Investment

2.1 Government Incentives and Policy Support

Many governments now prioritize clean energy in their stimulus packages and infrastructure bills. These policies often include:

- Tax Credits for installing solar, wind, or energy storage solutions.

- Subsidized Loans for renewable energy R&D.

- Grant Programs focusing on cutting-edge AI analytics or smart grid applications.

AI startups frequently benefit from these initiatives, receiving financial support that de-risks investment. Plus, supportive government frameworks expedite market adoption by allowing faster integration into public utilities and municipal projects.

2.2 Corporate Demand and ESG Mandates

Major corporations increasingly adopt Environmental, Social, and Governance (ESG) criteria, pushing for reduced carbon footprints and sustainable operations. Firms like Amazon, Google, and Microsoft have pledged to source 100% of their power from renewables and are investing heavily in the AI tools that make it feasible. This corporate shift further fuels the market for AI-based clean energy solutions, ensuring robust B2B revenue channels for startups.

2.3 Growing Climate and Consumer Awareness

Consumers—especially Millennials and Gen Z—are more eco-conscious and willing to pay a premium for products and services aligned with sustainability. Renewable energy solutions, backed by AI, not only promise cost savings over time but also resonate with social and environmental values. As a result, companies that embrace green tech often enjoy brand loyalty and positive public sentiment, giving them a competitive edge.

2.4 Capital Injection from Diverse Sources

The push for clean power and AI has not gone unnoticed by the global investment community. Venture capital firms, private equity, angel investors, and even crowdfunding platforms are funneling money into AI-driven startups focused on energy optimization, grid tech, and battery breakthroughs. With record-breaking IPOs and acquisitions in the clean tech space, early investors have more examples of profitable exits, boosting overall confidence.

In essence, these market forces converge into a robust investment thesis: AI-driven renewable energy is not a speculative gamble but a tangible, high-potential opportunity backed by strong policy support, growing consumer demand, and proven financial returns.

3. Core Benefits of Merging AI and Clean Power

3.1 Enhanced Efficiency and Output

One of the biggest headaches in renewable energy is variability. When clouds block the sun or the wind slows, production dips. AI can harness predictive analytics—drawing on historical and real-time weather data—to anticipate these fluctuations and adjust accordingly. This results in smoother operations, optimized energy dispatch, and lower wastage.

3.2 Real-Time Grid Optimization

Modern power grids are evolving into smart grids, requiring constant monitoring and fine-tuning. AI can integrate with IoT sensors and advanced metering infrastructure to regulate energy flows in real time. This improves grid stability and reduces the risk of blackouts, particularly critical in regions prone to extreme weather or aging infrastructure.

3.3 Lower Operational Costs

By deploying AI for predictive maintenance, startups can detect early signs of wear and tear in turbines, solar panels, or battery systems before they escalate into costly failures. Proactive repairs extend the lifespan of equipment and minimize downtime, both of which improve the bottom line and delight investors.

3.4 Rapid Scalability

Software-driven approaches scale far more quickly than hardware-centric ones. AI models can be updated and deployed across new sites with minimal friction, allowing AI-driven renewable energy startups to expand globally—capturing large market shares within tight windows of opportunity.

3.5 Competitive Edge and Differentiation

In an increasingly crowded renewable energy market, differentiation is key. AI-based improvements in efficiency, reliability, and user experience can set one startup apart from another. Innovative algorithms can provide a proprietary moat, making it harder for competitors to replicate the same level of performance without substantial time and capital investment.

From operational to financial, the benefits of merging AI with clean power are compelling. When done right, this union can deliver high ROI, strong social impact, and market advantages—exactly the trifecta investors are seeking.

4. Step-by-Step Guide: How to Evaluate AI-Driven Renewable Energy Startups

Investing in any emerging tech sector demands due diligence, especially where AI is involved. Below is a blueprint for vetting these startups thoroughly:

4.1 Identify the Niche

- Solar Optimization: Some startups focus on solar forecasting and panel efficiency improvements.

- Wind Farm Management: Others tackle turbine control and weather analytics.

- Battery Storage: AI can optimize charging and discharging cycles, essential for bridging supply-demand gaps.

- Grid Tech: From smart meters to distributed energy resource management, many startups address grid-level challenges.

4.2 Assess the Team

- Technical Skill Set: Confirm the presence of AI experts, data scientists, and energy sector veterans.

- Leadership Experience: Founders who have previously scaled startups or worked at established energy companies often have better strategic insight and networks.

- Advisory Board: A strong board with industry luminaries, academic partners, or ex-regulators can open doors and validate the business model.

Case in Point: If a company aims to revolutionize wind farm efficiency but lacks wind energy experience among its leadership or advisors, proceed with caution.

4.3 Examine the Technology

- Core AI Models: Are they using machine learning, deep learning, or simpler analytics? Each has its place, but the underlying approach should align with the startup’s stated goals.

- Data Sources: More robust data sets typically equal more reliable AI outputs. Check if they have exclusive access to valuable, large-scale data—like weather feeds, historical grid stats, or proprietary sensor networks.

- Product Differentiation: Does the startup offer a unique algorithm, patent, or method that outperforms generic solutions?

4.4 Check the Market Fit and Scalability

- Customer Segment: Identify whether they’re targeting utilities, corporations, residential users, or governments. Each segment has different sales cycles, pricing dynamics, and risk profiles.

- Geographic Expansion: Some solutions may flourish in developed markets with advanced grids, while others thrive in emerging markets with off-grid demands.

- Revenue Model: Is the startup selling software subscriptions, taking a revenue share, or offering hardware + software bundles?

4.5 Review Financials and ROI Potential

- Funding Stage: Early-stage startups may have higher risk but potential for outsized returns. Later-stage ventures might offer more stability but less explosive growth.

- Burn Rate: AI development can be resource-intensive. Evaluate whether the startup has a clear path to profitability or follow-on funding.

- Exit Scenarios: Understand your exit strategy—whether an IPO, a strategic acquisition by a larger energy firm, or even a merger with another green tech player.

5. Case Studies and Real-Life Examples

5.1 DeepWind Analytics: Reinventing Wind Turbines

Overview: DeepWind Analytics developed a machine learning platform that optimizes wind turbine performance by analyzing weather predictions, turbine data, and historical outputs in real time.

- Challenge: Wind farms experienced uneven output due to changing wind speeds, causing erratic supply to power grids.

- Solution: DeepWind’s predictive model adjusts turbine blade angles for maximum efficiency, significantly increasing power generation by up to 15%.

- Outcome: Within two years of pilot testing, the company attracted $50 million in funding and struck partnerships with global wind farm operators, culminating in a multi-fold return on investment for early backers.

5.2 SolarVision AI: Forecasting Solar Energy in Cloudy Regions

Overview: SolarVision AI, a startup specializing in satellite imagery and cloud modeling, developed a forecasting tool for solar farms located in traditionally overcast areas.

- Challenge: Operators in regions like Northern Europe and parts of Asia faced reliability issues due to frequent cloud cover.

- Solution: SolarVision’s proprietary AI integrated live satellite data with advanced climate models to predict solar output hours or days in advance.

- Outcome: This led to a 10% improvement in solar farm utilization rates, enabling more competitive pricing and grid stability. The startup quickly scaled across four continents and was eventually acquired by a global energy giant, rewarding early investors handsomely.

5.3 GreenGrid Ops: AI for Smart Grid Management

Overview: GreenGrid Ops developed a cloud-based platform that coordinates supply and demand across distributed energy resources—solar panels, wind turbines, energy storage systems, and even electric vehicles.

- Challenge: Utility companies struggled to integrate multiple renewable sources into outdated grid infrastructures.

- Solution: Using real-time data from IoT sensors, GreenGrid’s AI dynamically orchestrates power flows, adjusting for usage spikes and weather shifts.

- Outcome: The platform helped reduce grid congestion and energy losses by over 20%. Not only did utility companies save millions in operational costs, but the solution also improved customer satisfaction by reducing outages.

These success stories underscore the financial viability and positive social impact of AI-driven renewable energy startups. From optimizing turbine performance to balancing entire grids, the potential for significant returns—both monetary and environmental—is undeniable.

6. Common Pitfalls and How to Avoid Them

6.1 Underestimating Hardware Complexities

- Mistake: Investors assume software-based AI solutions are “plug-and-play” for energy hardware like turbines or panels.

- Avoidance Strategy: Ask for specifics on integration timelines, compatibility, and the cost of retrofitting existing equipment. Collaboration with established hardware vendors can mitigate these risks.

6.2 Overlooking Regulatory Constraints

- Mistake: Not factoring in local utility regulations, permitting processes, or energy market rules.

- Avoidance Strategy: Evaluate the startup’s regulatory compliance measures. Do they have legal experts or partnerships with local authorities? A great product can stall without the right approvals.

6.3 Ignoring Data Quality Issues

- Mistake: Believing AI solutions can function optimally without robust, clean data.

- Avoidance Strategy: Investigate the startup’s data pipelines, data cleansing protocols, and their methods for handling missing or inaccurate data. Quality data is the fuel for accurate AI predictions.

6.4 Misjudging the Sales Cycle

- Mistake: Energy sector deals—especially with utilities—can be slow and bureaucratic. Investors sometimes expect rapid traction akin to B2C startups.

- Avoidance Strategy: Plan for a longer sales cycle and check if the startup has an interim strategy (pilot projects, smaller B2B deals) to maintain cash flow.

6.5 Lack of Skilled Workforce

- Mistake: Overestimating the ease of recruiting top-tier AI and energy specialists, which are both in high demand.

- Avoidance Strategy: Confirm the startup’s hiring pipeline and employee retention strategies. A single data scientist or energy engineer can’t shoulder all the technical responsibilities.

By staying vigilant and conducting thorough due diligence, investors can sidestep these pitfalls and maximize long-term returns in this rapidly expanding market.

7. Future Insights and Trends

7.1 Advanced Energy Storage and AI Integration

The next frontier likely revolves around battery technology. With the surge in electric vehicles (EVs) and decentralized power grids, high-capacity and smart battery systems will become increasingly important. AI can optimize how, when, and where these batteries charge and discharge, ensuring that power is always available at the lowest possible cost.

7.2 Decentralized Autonomous Grids

Blockchain and AI could merge, creating decentralized microgrids where homes, businesses, and communities can trade energy peer-to-peer without relying solely on large utilities. This setup has major implications for rural and off-grid areas, offering energy autonomy and security.

7.3 Carbon Capture and AI

Beyond renewables, carbon capture technologies are emerging as another tool to combat climate change. AI could optimize capture processes, reduce operational expenses, and automate storage logistics, paving the way for a new subsector of clean tech investments.

7.4 AI-Driven Virtual Power Plants

Virtual power plants (VPPs) aggregate multiple distributed energy resources—such as rooftop solar panels and energy storage units—and operate them like a unified power plant. AI can handle the massive complexity of balancing these resources across varied geographies and timescales, opening up new revenue models and greater grid resiliency.

7.5 Cross-Industry Collaborations

Expect deeper collaborations between the AI and energy sectors. Automotive firms, software companies, and even data center operators are all exploring how to fuse their expertise to accelerate the energy transition. Investors should keep an eye on partnerships that blend domain knowledge and capital from multiple industries.

If you’re preparing for upcoming changes, now is the time to build networks, monitor cutting-edge startups, and even co-create solutions with research labs, non-governmental organizations (NGOs), and large corporations. The next decade will likely witness exponential growth in AI-driven renewable energy—you don’t want to be left behind.

8. Conclusion

The marriage of AI and clean power represents one of the most compelling investment opportunities of our time. Plunging costs, strong policy support, and an accelerating shift in consumer and corporate values make AI-driven renewable energy startups particularly attractive. These companies are addressing global challenges—climate change, grid inefficiencies, and escalating energy demands—in ways that yield economic and social benefits.

Key Takeaways

- Robust Market Drivers: From government incentives to corporate ESG mandates, multiple forces are fueling investment in green tech.

- High-Potential Returns: As our case studies show, well-chosen AI-energy startups can bring significant ROI and potential for quick scale-ups or acquisitions.

- Strategic Evaluation: Use a step-by-step approach—focus on technology, team, market fit, and financial viability.

- Future Is Bright: Trends like decentralized grids, advanced energy storage, and carbon capture are opening new pathways for both innovation and profit.

Ready to get started? Explore your next step in the AI-powered energy revolution now.

Call-to-Action

- Download Our Comprehensive Investor’s Checklist for AI-driven renewable energy ventures to streamline your due diligence process.

- Sign Up for Our Newsletter to stay informed about emerging technologies, funding rounds, and policy shifts that affect green tech investing.

- Schedule a One-on-One Consultation if you’re seeking personalized advice on how to add AI-energy startups to your investment portfolio.

Take action today and position yourself on the cutting edge of sustainable innovation—and reap the financial and societal rewards that follow.

9. FAQs

Below are five frequently asked questions that potential investors often have about AI-driven renewable energy startups:

1. Are AI-driven renewable energy startups riskier than traditional tech ventures?

They can be, due to the complexities of merging hardware with software and dealing with sometimes lengthy regulatory processes in the energy sector. However, government incentives, strong market demand, and the potential for transformative ROI often offset these risks. As always, conduct thorough due diligence.

2. How long does it typically take to see returns on investment?

This can vary widely based on the startup’s business model and target market. Enterprise or utility-focused startups may take longer due to lengthy sales cycles, whereas residential-focused solutions might generate revenues more quickly. Typically, investors should prepare for a 3–7 year horizon.

3. Do I need deep technical knowledge of AI or energy systems to invest?

Not necessarily. It helps to have a basic understanding of both fields, but you can rely on experts for detailed analysis. Focus on the strength of the team, market opportunity, and revenue model. Bringing in a trusted advisor or consultant can also bridge any knowledge gaps.

4. Which geographical markets are most promising for AI-powered renewable energy?

Regions with aggressive climate policies and fast-growing energy demands—like parts of Europe, North America, Asia, and Africa—are hotspots. It’s crucial to consider local policy frameworks, energy infrastructure maturity, and the presence of supportive ecosystems.

5. How do AI-driven solutions handle variability in wind and solar energy?

Through predictive analytics and machine learning. By analyzing historical performance and real-time weather data, AI algorithms can forecast energy production and manage energy storage or load balancing to smooth out fluctuations, ensuring a consistent and reliable power supply.